when the alarm sounds: Are you really ready to evacuate

Every organization likes to believe it can evacuate quickly and smoothly during a fire alarm, but reality has a way of testing that assumption. In multi-story office buildings, especially on the upper floors, an evacuation can quickly highlight challenges that

Can You Control Your Insurance Cost?

In 1752, Benjamin Franklin founded the Philadelphia Contributorship for the Insurance of Houses from Loss by Fire, which is still America’s oldest, continuously operating insurance company. Massachusetts enacted the first state law requiring insurance companies to maintain adequate

Risk, Readiness, and Repercussions

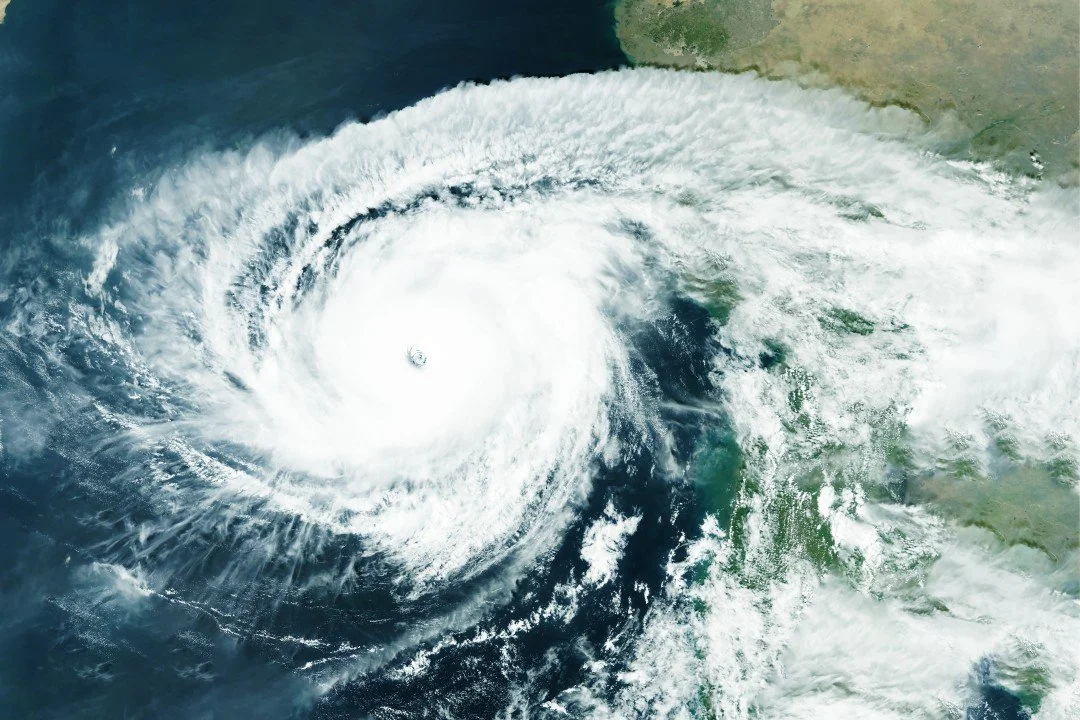

The New York Times reporter, Michael Barbaro, interviewed Judson Jones on “The Daily” regarding #hurricane threats, and their occurrences in the future. Judson highlighted

Rising Gun Risk Incidents at Restaurants

In recent times, the issue of guns in restaurants has gained attention, sparking debates about safety and the potential risks associated with such incidents. Bradyunited.org cited that 117,345 people are shot every

Psychological Safety and Conflict Resolution

As we approach the Occupational Safety and Health Administration "Safe and Sound" Campaign week it’s vital to address a critical aspect of workplace safety that often goes unnoticed: the relationship between psychological safety and

risk management matters; are we managing it properly?

According to an ALS article, the Wall Street Journal reported a poll identified through executives that fewer than 20 percent of companies properly manage risk (ALS Group, 2014). This can be due

the connection effect

-

the connection effect -

Prefer listening over reading? Dive into The Connection Effect — quick conversations with people you’ll want to hear from and maybe even connect with.